Tax Competition: Swiss Lessons From The Belgian Constitutional Debacle

From the desk of Paul Vreymans on Wed, 2010-10-13 13:17

Walloon leaders and a few Flemish politicians to the left of the political spectrum are steadily scaring their people that the extension of fiscal autonomy would lead to tax competition and the dismantling of the interregional solidarity. In the same claim they frighten their followers that tax competition would lead to automatic and massive loss of prosperity for Wallonia (the region that has been at the receiving end of the interregional transfers for many decades now). Curiously enough even economics professor De Grauwe agreed with this populist argument.

This representation of facts is obviously erroneous for two reasons.

- Regional tax autonomy does not exclude other mechanisms of interregional solidarity when negotiators consider this justified.

- The creativity and sense of responsibility resulting from fiscal autonomy generate a dynamic of rationalization and innovation of which both regions benefit. The welfare effects thereof are generated autonomously and obviously do not go at the expense of the other region.

The political statement that fiscal autonomy and tax competition between regions would be detrimental is therefore fundamentally flawed.

For the political establishment, fiscal rivalry between regions would of course result in their discomfort of having to spend taxpayers' money less lavishly. For the subjects however, both Walloon and Flemish citizens lower on the social ladder, tax competition can bring only blessings.

The consumer benefits of a competitive environment are well known in the private sector. Competing businesses assure lower consumers prices, better products and favorable sales terms. At the macro level, the creative force behind competition leads to optimal allocation of resources and increases the wealth of all.

The same advantages would apply to the public sector if this were to operate in a competitive environment. Rivalry between administrative entities would ultimately result in improved public service at better tax conditions. Citizens should therefore welcome tax competition rather than fear it. Likewise interregional cartel agreements on a minimum tax rate or citizen-unfriendly public services should be shunned like the plague. Such restrictions would cripple the autonomy and perpetuate the many Belgian inefficiencies and the country's democratic deficit.

Swiss Model

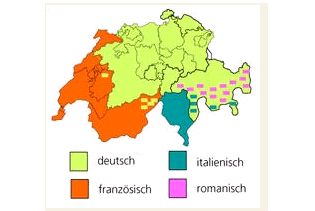

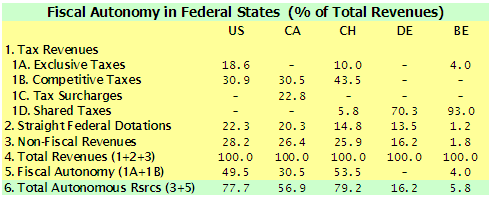

Fiscal autonomy is extremely limited in Belgium. The share of autonomous regional resources amounts to hardly 5.8% of the federal budget. In other federal states such as Switzerland or Canada this proportion reaches up to 79%. Switzerland, the country with 7.5 million inhabitants, four national languages and four religions is a complex country just like Belgium. Still, thanks to its decentralized state model, it seems to enjoy eternal peace between communities.

The lion's share of the Swiss budgets, authority and fiscal policy comes within the competence of the 26 autonomous cantons. Differences in marginal income tax rates are rather high, varying roughly from 2 to 20 percent. Total public spending hardly reaches 35% of GDP. Still the country has exceptional medical and social services. It is leading in several industrial sectors and is in the front position in technological, ecological and medical advances. In just two generations, Switzerland developed from an agricultural country to one of the most progressive and wealthiest nations in the world. The Swiss declare themselves as extremely satisfied with their quality of life, and are counted among the happiest people in the world.

Fiscal autonomy

Decentralized governance and fiscal competition have clearly paid off in Switzerland. Rather than to frustrate tax competition in a unitary tax system, Belgium also should encourage it through decentralizing fiscal and social responsibilities to a low administrative level close to the citizens, preferably to the provincial level.

Small administrative units such as the Belgian provinces and the Swiss cantons have multiple advantages. Governors are close to their people and understand their desires; local authorities can adapt their socio-economic policies to local needs and conditions, and closely involve their citizens in governance through referendums.

As an added benefit, the decentralized Swiss state model can do with two management levels fewer than the Belgian. Switzerland is neither plagued by the ubiquitous tutelage of the EU and the constraints of a common currency, nor does its decentralized structure need the intermediate government level of regions and communities. Such a simple administrative structure keeps the lines of communication shorter, allows for a neat separation of responsibilities, and limits growth of the parasitic public sector to a minimum.

But the biggest advantage of all is that citizens and businesses can move rather easily when a neighboring canton provides better public services at better tax conditions. Such an ultimate democratic control by the community keeps the growth of the state apparatus within reasonable limits and ultimately results in good governance. Thanks to its unique state model Switzerland became the fourth wealthiest nation in the world despite its scarcity of arable land and natural resources and its most difficult terrain.

Clear separation of responsibilities

Political conservatism crippled prior Belgian state reorganizations to half-hearted reforms and left Belgium at present with the least efficient state apparatus in Europe. Its cost-heavy administrative structures are way too centralized. Structural reforms in accordance with modern principles of subsidiarity are actually decades overdue.

The complex and over-centralized Belgian state model with its five levels of government and overlapping responsibilities steadily cause conflicts of authority and cripple the country into immobility. Belgian politicians fruitlessly argued for two years about a new color for the Belgian license plates and ten years over the construction of a tunnel the country, its commuters and its harbor so urgently needed.

In a globalized world, our over-indebted nation can no longer afford the waste of crippling and parasitic government bodies. If Belgian politicians really care about the welfare of the country and its citizens rather than about the lucrative mandates the current structure offers them, then they would better take inspiration from the Swiss state model.

A decentralized structure based on 10, 11 or 12 provinces is perfectly conceivable in Belgium. Just as in the decentralized Swiss model, the intermediate level of regional governments provides no added value and could simply be abolished. Unless of course politicians prefer regionalizing the responsibilities of the federal level, and abolish the unitary Belgian structure.

But even the total transfer of responsibilities from the Belgian government level to the sub-central level of the Flemish and Walloon Regions is in fact only a modest step towards subsidiarity. Such a "federalization" to the sub-central administrative level hardly provides any new safeguards against bureaucracy or incentives for empowerment and good governance.

The Flemish urban planning regulations, introduced soon after the matter was regionalized, is the most striking example that regionalization actually can make things worse. This over-restrictive central planning scheme in the purest Soviet style caused prices of building plots to triple in less than 10 years. Not without reason ever more citizens rightly complain about the increasingly patronizing regional Flemish government. Communal authorities, chambers of commerce, farmers and entrepreneurs alike strongly condemn the ever-increasing regional bureaucracy.

Rethinking Belgium

Really decentralized governance could be realized if the provinces became autonomous administrative entities, and both the national as well as the regional government levels were abolished, or reduced to the status of a consultative body between sovereign provinces. Not only would the economization on bureaucratic personnel be gigantic, the odds for good governance would finally become real.

For understandable reasons, career politicians, unions and the hundreds of thousands of civil servants populating the national and regional government levels, all laugh away such federation of independent provinces as a utopian fantasy. The reality is that Belgian Provinces are most suitably sized administrative units. Not only are they economically viable entities, but they are likely to develop into dynamic growth poles when governed as sovereign nations. Luxembourg, the neighboring sovereign state with a population half the size of a typical Belgian province it is the empirical evidence of that.

Barely a quarter century ago Luxembourg had a predominantly heavy industry, very similar to Wallonia, and was equally struggling to survive globalization. Unlike the Walloon Region, Luxembourg as a small and independent nation free from constraints of superstructures, was able to conduct a decentralized industrial policy adapted to its territory. In less than one generation Luxemburg restructured its economy into a modern service industry. At present Luxembourg has in fact an economic track record even better than Switzerland. Today its 490,000 residents enjoy the highest living standard in the world, nearly twice as high as the Belgian, confirming thereby the general rule that small states systematically and significantly deliver better performances.

Small nations such as Switzerland and Luxembourg prove that decentralized governance is functioning, and delivers both life satisfaction and prosperity. The Swiss cantonal autonomy guaranteed community peace since decades. With such a modern decentralized state structure Belgium could very well become a European Hong Kong or Singapore.

Hopefully it will not take another decade before Belgian politicians finally realize that decentralization is the only way to go.