The Battle Of Europe - Reality vs Its Denial

From the desk of Richard Rahn on Wed, 2010-06-23 11:18

Brussels, Belgium -- For the past 200 years, much of the fate of Europe has been determined near this lovely city. That is equally true at the moment as the leaders of Europe meet in what slowly is becoming the capital city of Europe to make decisions that well may determine whether the euro and even the European Union will continue to exist.

As every schoolchild knows, Napoleon was finally defeated two centuries ago at the battle of Waterloo - close enough to Brussels to be considered a suburb. The great battles of World War I were fought largely within a drive of an hour or so from Brussels, to the west.

Dunkirk, where the British army escaped from continental Europe in 1940 to fight again is a relatively short drive to the northwest of Brussels. Finally, the Battle of the Bulge in 1944 - the last great battle of World War II on the Western front - was fought in an area not all that far south of Brussels.

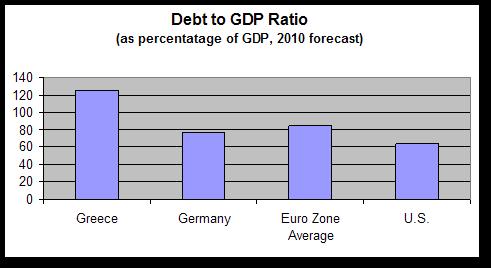

The current battle being fought in Europe is between the economic realists and the reality deniers. Most of the eurozone countries are on an unsustainable spending path in that government spending is or will be growing at a faster rate than gross domestic product (GDP), and as a result, government debt is growing as a percentage of GDP. This trend cannot continue because interest payments for debt service will eventually eat the entire budget. Governments must either sharply reduce spending growth, which means the growth in entitlements, or resort to temporary solutions, such as partial or full debt default, or massive inflation.

To avoid becoming other Greeces, governments will need to reduce the number of government employees, greatly increase their retirement ages, reduce the number of their vacation days and sharply curtail their other benefits. As would be expected, public employees are protesting with strikes, demonstrations and, in a few cases, riots. Retirement ages for those on government pensions also must be increased steadily because of the rise in life expectancies and the falling number of workers per retired person.

It takes strong leaders to deliver sour medicine to the populace, particularly in democratic countries. Such leaders are largely absent in Europe at the moment. Worse yet, the major moderate parties in many European countries are losing ground and being forced into unstable and weak coalitions.

The European Central Bank has lost much of its independence, with the president of the European Council gaining power without clear legal authority. Most of the eurozone members are in violation of their treaty obligations regarding debt and deficits, yet there is no authority to bring them into compliance.

What will happen? It is easy to paint a picture of increased political and economic chaos in Europe, the end of the euro and the rise of new dictators, much like what happened in the 1930s. However, a more likely and more optimistic scenario would be as follows: The Germans, even with a weak coalition government, will make the necessary spending reductions - but in doing so will almost gut their remaining defense budget. Once the Germans have put themselves back on the track of fiscal sustainability, they will be in a much stronger position to pressure their fellow eurozone member countries to do the same.

The German people and the German government are not going to give unlimited bailouts to their fellow eurozone members. Once this becomes clear, the other eurozone countries will be forced to put their fiscal houses in order or leave the eurozone. Most will understand that the pain of putting one's fiscal house in order will be far less than the economic misery resulting from leaving the eurozone. Yet it might be necessary for one country, such as Greece, to leave for the others to see what a really bad alternative that would be.

The current European war between the economic realists and the reality deniers will stagger on for many months and, perhaps, a few years. The realists will not have an easy time of it, not only because of entrenched European special interests - government employees, unions, corporations and others on the government dole, etc., but also because the U.S. economy is likely to be weak for the next few years as a result of the disastrous tax-and-spend policies of the Obama administration. Ultimately, reason is likely to prevail because the films of what happened in the last century when reason did not prevail are shown often enough to remind everyone of the alternative.

Ultimately, reason is likely to

Submitted by Edensfelt on Tue, 2010-06-29 23:50.

"Ultimately, reason is likely to prevail because the films of what happened in the last century when reason did not prevail are shown often enough to remind everyone of the alternative."

I don't agree that a Hitlerite-type regime would likely re-emerge if the whole EU project were to collapse staring with the Eurozone.

However, what almost certainly, would occur is that the Cult of Islam adherents would use a collapse to initiate a full-scale jihad across Europe and we all full-well know precisely what such a scenario would look like. It would make the WW11 Holocaust pale into comparative insignificance.

Not too late

Submitted by marcfrans on Mon, 2010-06-28 01:34.

@ Dughall

It is rarely ever "too late". All that is needed is restoration of confidence, and time will take care of the rest. To restore confidence, what is needed is credible fiscal and structural policies.

It is not true that "any cut in spending collapses tax revenues and increases unemployment". Presumably you mean 'government spending' here. The business cycle is a constantly recurring phenomenon, i.e , national income will continue to fluctuate (generally along an 'underlying' upward sloping curve), irrespective of what goes on with government spending. But the latter can have an impact on the length of certain parts of the cycle, i.e. speed it up or stretch it out', and it can also affect the slope of the underlying trend line (in both directions).

The reason for high "youth unemployment" in Southern Europe is not because of 'too little' government spending, but rather because of too much government spending on measures that make their labor markets inflexible. Certain types of spending increase unemployment! You seem to be stuck in a 'Keynesian mind set.

Sure, debts may still be rising if deficits are cut - they will keep rising as long as there are deficits! - but that is not the issue. The relevant issue is to restrain the growth in the debt RATIO to GDP, not the debt in absolute terms. For many Western countries the current debt ratios are 'too high', but they are still below what they were at the end of world war 2. It wasn't "too late" for them then, why should it be too late now with lower debt ratios?

I agree with your contention about the North-South transfers within Europe. Inside Belgium the same kind of transfers exist in a smaller 'cosmos', but they seem to be more or less "permanent". I am not so sure that they could not be similarly become 'permanent' within Europe.

Contrary to you, I do believe that Greece has more to gain from staying, than from leaving EMU. Its politicians in the past decade have proven to be unable to pursue responsible fiscal policies, even with the EU and the ECB (insufficiently) looking over their shoulders. What makes you think that they willl perform better outside EMU? If I were an individual thoughtful Greek citizen, which fortunately I am not, I would insist that Greece stay inside the EMU so that its politicians remain subject to some external control. Clearly, the Greek voting public did not keep its politicians 'accountable'.

It's too late

Submitted by Dughall on Sun, 2010-06-27 09:22.

The article assumes that all that's required is financial discipline on the part of national governments to restore sustainability. Yet any cut in spending collapses tax revenues and increases unemployment. Ireland has already shown remarkable discipline in cutting spending but has not achieved substantial deficit reduction. The same effort in Southern Europe is politically impossible. Already youth unemployment is around 40% in Spain:

http://www.spanishnews.es/20091003-spains-youth-unemployment-rate-hits-3...

Even if, with supreme effort, deficits can be reduced, debt keeps rising. Debt servicing has already become a substantial portion of national budgets. It's unrealistic to expect brutal austerity to be acceptable if even the most optimistic prospect is to stabilise payment to creditors of several % of GDP permanently.

Germany doesn't want to accept high inflation and a debased currency, indeed, this would only make its already embarrassingly high export surplus even higher. Southern Europe can't possibly control its debt without currency devaluation to restore competitiveness. The present situation has been exacerbated by irresponsible governments but even without them, it was inevitable eventually. Northern and Southern Europe have fundamentally different cultures. The Euro project could only be sustained with enormous, permanent subsidies from north to south. This is not what the German electorate signed up for when it accepted the Euro and as Mr. Rahn writes, this will not be acceptable.

Where I think Mr. Rahn is mistaken is that he thinks leaving the Eurozone will be worse than staying in it. Leaving, for Greece say, will be painful in the short term but with its own currency an ex member can partially default if it needs to and regain lost competitiveness by devaluing. It's the foreign creditors who really need to fear this outcome, not the country concerned.

strong leaders

Submitted by Frank Lee on Thu, 2010-06-24 04:20.

The author writes, "It takes strong leaders to deliver sour medicine to the populace, particularly in democratic countries. Such leaders are largely absent in Europe at the moment." Curiously, the view from America is that heretofore irresponsible leaders in Europe have done an abrupt about face and become fiscally responsible, even if the rioting citizenry doesn't want them to be, whereas in America we have tea party activists and others among the citizenry pushing for fiscal responsibility, while Congressional and Presidential leadership remains irresponsible. We'll see what happens this fall and in 2012: perhaps our leadership will catch up with the citizenry.