The Fraud Of Austerity

From the desk of Richard Rahn on Sat, 2012-05-12 11:12

Denial is leading to collective economic suicide in Europe and the United States. The French elected a socialist president who wants to raise taxes on those elusive rich and keep spending as if there is no tomorrow.

Many on the left, including European socialists in tandem with the New York Times and its economist Paul Krugman, are falsely claiming that Europe and even the United States are being saddled with "austerity." Their claim is that governments are not spending enough to reduce unemployment. They want higher taxes on the most productive plus bigger government.

They all suffer from a collective memory loss. Don't they remember that socialism did not work? Every time the big-government "solution" has been tried for the past two centuries, it has failed, but those on the left seem to be incapable of learning.

When the current economic crisis began -- largely caused by a government-created housing bubble -- we were told that if the government spent an extra trillion dollars or so and ran up the deficit, all would be well. Did it work as advertised in the United States? No. In the United Kingdom? No. In France? No. In Italy? No. In Spain? No. And not even the left wants to talk about Greece.

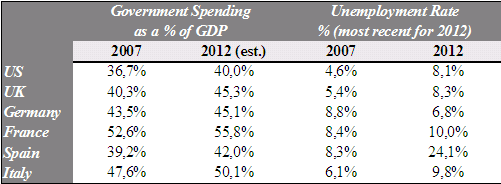

The chart below shows that rather than the austerity the left is whining about, government spending has risen as a share of gross domestic product (GDP) in all of the major economies. Again, the left said unemployment rates should have come down by now, but the opposite is happening. The U.S. "official" unemployment rate has come down slightly, but the percentage of the labor force at work continues to decline, so the real unemployment rate is approximately 15 percent.

The irony is that the refusal by those on the left, in both Europe and the United States, to deal with the "entitlement" problem is going to cause an involuntary austerity in which real incomes are going to fall for most people. Incomes have not been rising as fast as inflation in the United States and most places in Europe, but what has happened is only a very mild introduction to what is going to happen.

GDP-to-debt ratios keep rising in all the major economies, and realistically, this will continue until a reversal in policy or a surge in inflation begins to erode the value of the debt. Chancellor Angela Merkel in Germany has demanded that her fellow Europeans reverse the growth in spending to deal with fiscal reality and save the euro.

The elections in France and Greece show that Mrs. Merkel's advice will be ignored and the European Central Bank will be pressured to keep printing money - by sovereign bond purchases and/or rate cuts on loans to banks - which ultimately will mean a lot more inflation, resulting in a real drop in incomes.

Of the major economies, only Germany has managed to reduce unemployment, and that was largely by major labor reforms, which now make it possible to fire German workers so employers no longer are so reluctant to hire new workers. Even so, the German economy is slowing down and may be dragged into the new recession that the other European economics are in or about to enter.

The next year is not going to be pleasant. The new European recession will only deepen and spread as, once again, the socialist "solutions" add to the problems. The United States is facing a massive 3.6 percent of GDP tax increase on Jan. 1, which will occur unless Congress extends the George W. Bush tax cuts and the other major personal and business tax provisions that are set to expire at the end of the year.

The extensions will require both houses of Congress to pass them and President Obama to sign them into law. Even if the Republicans win both Houses of Congress and Mitt Romney is elected president, the Republicans will not take office until January - after the tax provisions' expiration date.

There is no guarantee that Mr. Obama and the Democrat Senate will pass the necessary tax extensions during the lame-duck session, whether they win or lose. Even if the Republicans win, they will not have the necessary 60 votes they might need in the Senate if the Democrats refuse to go along with the extensions.

The uncertainty about what is going to happen will build through the remainder of the year, which will inhibit business expansion and job growth. This, coupled with the ongoing avalanche of new bank regulations, and foreign interest and dividend reporting requirements, is going to drive productive capital out of the United States.

The rich in Europe and the U.S. are not just going to sit around to be fleeced by corrupt and incompetent governments. Being rich means you and your capital are mobile. There are many nice places on the globe where rich people and their money are well-treated.

Europe is in recession, and the odds are that by January the United States will be back in recession. The central banks will inflate the currency to deal with the government debt problems, the people will be poorer, and the rich will have left.

Come on

Submitted by kappert on Sun, 2012-05-20 11:04.

... folks, marcfrans is trying so hard to defend his Reagan-era buddy.

"Socialism"

Submitted by antibureaucratic on Fri, 2012-05-18 14:31.

I take exception to the comment that France has elected a "socialist" president - at best, he is bourgeois-democratic - and it is fortunate that some ultra-rights have not taken power. Still, I see no solution to Europe's current (Greece alone is 1 Trillion dollars) crisis. The best USA can offer is to revert to the gold standard, because they have cleverly secreted many tonnes of gold away in fort Knox.

We see now Germany ascending - logical, as she has the commie east and the capo west combined, and a powerfully dominant GDP.

The question is, who is really on the rise??? Is it China, India or will Europia take back her rightful position if she can put aside her petty internal squabbles and undo the mistakes of colonialism and Imperialism in the past?

Focus, please

Submitted by marcfrans on Sat, 2012-05-19 17:22.

@ antibureaucratic

1) The table shows that the share of government spending in GDP is approaching 60% in France, the highest of any major Western country, and Hollande wants to increase that further. When are you not going "to take exception" to calling him a socialist? When the government's share in the economy reaches.... 80%...or does it have to be 99%... to overcome your fear of calling him what he is? Him being a socialist, does not preclude him from being also "bourgeois-democratic".

2) Putting Greece and "1 Trillion dollars" in one sentence is not very smart. It reveals a lack of a proper sense of proportionality.

3) Germany's economic rise has little to do with the inclusion of the "commie east". It is the result of better German economic policies in recent decades, compared with the economic policies pursued by Germany's neighbors (who are also its main competitors).

4) The current internal squabble in Europe is not a "petty" one, but rather one of fundamental importance in determining its future direction. And the notion that Europe could "undo the mistakes of colonialism and imperialism in the past" is just plain silly.

@MarcFrans

Submitted by antibureaucratic on Wed, 2012-05-30 08:20.

re: 1 we obviously have very different ideas on what is "socialism"

re: 2 - my comment was alluding to an estimate in the media that if Greece defaults approx 1 Trillion dollars (Australian?) is at stake

re: 3 - I would be interested to know particularly which of Germany's recent policies has led to her rise, relative to her neighbours

re: 4 - I take back the word petty, and yes Europe can not undo these mistakes.

Focus 2

Submitted by marcfrans on Wed, 2012-05-30 15:09.

1) My definition is: "using government compulsion to allocate resources". That is what government spending does, and that is why the share of G spending relative to GDP is an excellent indicator of "socialism".

2) What does that mean: "at stake"? Pure media hype.

3) In the first half of the past decade, Germany introduced a variety of measures that helped liberalize its labor markets, whereas most of its competitors continued with the trend towards lesser flexibility in their labor markets. Consequently, Germany's employers faced improving unit labor costs relative to most of their foreign competitors and, as a result, Germany' s employment and export performance has been much better than elsewhere.

4) It's a mixed picture. European colonialism and imperialism have had both positive and negative effects. "Mistakes" is too simplistic as a characterization.

why?

Submitted by kappert on Tue, 2012-05-15 10:26.

Why is this blog called 'Brussels Journal', allegedly discussing 'conservatism in Europe', while emitting blunt propaganda for U.S. bonus-hashers? We cannot expect bonus-hashers to give any clue to stabilise a decaying society, can we?

The article under discussion

Submitted by marcfrans on Tue, 2012-05-15 15:02.

The article under discussion was centered on a table with economic data concerning 5 European countries and 1 nonEuropean country, and the longest comment to the article contained a paragraph devoted to the special case of Germany.

It would appear that Kappert:

- cannot distinguish the essential from the superfluous

- does not know the difference between "for" and "from"

- cannot distinguish between a bonusbasher (not hasher) and a non-bonusbasher

- does not know the meaning of the word "propaganda" (he seems to confuse that with 'anything that he disagrees with').

So, yes, these are all signs of "a decaying society".

hooey

Submitted by Dan on Sun, 2012-05-13 20:27.

First the moderately productive produced a bunch of junk that wasn't needed where it was produced and wasn't affordable elsewhere. Then the "highly productive" cooked up a scheme to extend credit to those with low productivity so they could buy crap that they didn't need and couldn't afford. This kept the moderately productive employed and produced a windfall for the "highly productive."

Now the inevetable has happened and it is all the fault of the deadbeats who can't pay and obviously never could. What a crock o' shit. Reminds me of a conversation I had with my banker in 2008, when he tried to explain how a bunch of poor subprime borrowers crashed the economy with no culpability on his part; even though he fired his loan officers to cut costs and then wrote a Buchanan of loans without verification to increase profits.

hooey #2

Submitted by marcfrans on Sun, 2012-05-13 22:36.

@ Dan

First, If something is "not needed" and "not affordable" then it will not be produced (at least not in any great quantity). So, your first sentence does not make sense

Second, It is government that "cooked up a scheme", actually a variety of schemeS, to extend credit to people who could not afford it. And much of government is not part of "highly productive people". So your second sentence is dubious at best.

Your banker tried to maximize his profits in destructive ways (from a macroeconomic perspective). He could do that because government created 'moral hazard' by providing subsidies and guarantees (mainly through Freddie and Fannie). Almost everybody else would behave in the same rational way if faced with a similar situation. What do you think most higher education institutions are doing today? So, what is your point, really?

Hooey #3

Submitted by Dan on Mon, 2012-05-14 04:45.

When you state that things that are not needed and not affordable cannot be produced in significant quantities; you are relying on a variant of the efficient markets fallacy. Housing and autos should be proof enough. However if you want a rigorous debunking Google it; there are hundreds. Government was a willing partner however commercial banks were in the drivers seat; and everyone went along. No one wanted to be out of a job for lack of customers. Banksters wanted enormous profits; and bonuses they could keep after it all blew up. Everyone wanted to feel rich. All are complicit to varying degrees. Ultimately that which cannot be repaid will not be repaid. The sooner the insolvent default the better for everyone involved. I am sick of the bullshit moralizing. All it is accomplishing is radicalizing people and making things worse.

#4

Submitted by marcfrans on Mon, 2012-05-14 15:24.

@ Dan

1) Markets may not always be "efficient", but housing and cars are not "junk". No amount of googling will make it so.

2) What do you mean by "drivers seat"? Everybody will try to maximise their profits and, yes, everybody wants fat bonuses that they can keep. It is not because you and I do not get such bonuses that we should blame others for pursuing them. The "complicity" resides not in seeking such bonuses but in making them possible. And that is a matter of poor regulation and of moral hazard created by government. The latter has destroyed market discipline by interfering with normal risk management.

3) We agree on the solution: the insolvent should default. What is needed is transparency and not government obfuscation of risks and costs.

Great summary

Submitted by marcfrans on Sat, 2012-05-12 16:30.

Mr Rahn has provided an excellent summary, and the simple data table is very instructive. The share of government spending in total spending has continued to increase in all major Western countries and yet unemployment has risen everywhere, except in Germany due to liberalising labor market reforms started there a decade ago.

It is ridiculous to talk about "austerity" when governments continue to run major fiscal deficits, i.e. annually spend more than they take in. Governments continue to 'stimulate' the economy and, in so doing, they continue to undermine economic fundamentals. Keynesian aggregate demand management (i.s. fiscal deficits) makes only sense on a temporary basis within a given conjuncture or business cycle, but not on a continuing basis (year after year for decades).

Some would object and say that raising taxes could reduce those fiscal deficits. The answer is simple, raising taxes has generally negative supply side effects and, even in some cases with no supply side effects, governments will simply spend more if they take in more. Which brings us back to the data table, which shows higher unemployment going along with larger shares of government in economies.

The German 'exception' shows that the correlation is not as simple as it appears at first sight. The growing share of government in GDP depresses the growth rate, i.e. it has a negative effect on overall productivity. From a long term perspective, unemployment is not so much a function of small variations in total spending in the economy as it is a function of the flexibility of labor markets. We do not need more government spending. What we need is stability (predictability) in the tax system, structural labor market reforms that promote flexibility, and fiscal discipline (budget balance over the business cycle).