Reaganomics, a Success Story

From the desk of Luc Van Braekel on Tue, 2005-07-19 23:00

Time, Sep. 21, 1981

BELGIAN ADMIRATION AND INTEREST IN REAGANOMICS

Verhofstadt (right) with LVB (left), 1998

When I think of Reagan, I'm thinking of Reaganomics and the Laffer curve. (Enthusiastically:) Do you remember: a tax cut could create more revenues! Reagan is dead now, but several of his ideas are now self-evident. The Flemish government lowered the estate and gift taxes. Surprisingly, the government got more income.

Few Belgians have analyzed Reaganomics in such an exhaustive way as the retired financial consultant Willy De Wit from Antwerp. Today, he is a member of the Flemish independent think thank WorkForAll. Recently, he gave a lecture for “FACS” (Free Association for Civilization Studies), a Flemish libertarian think tank lead by Martin De Vlieghere. Loaded with facts and figures, De Wit proved that Reaganomics did deliver results and was a success story.

CRITICS OF REAGAN'S ECONOMIC POLICY

But before summarizing the lecture of Willy De Wit, let us listen to the opponents. Numerous they are and their voices ring loud in the media. In November 2001 Mia Doornaert, a well-known Belgian journalist, wrote: “Ronald Reagan was not a great American President”. In the same leading Flemish newspaper De Standaard, Evita Neefs wrote three days after Reagan's death: "America is losing a sympathetic blockhead. He was not particularly intelligent, but extremely charming". These sentences are typical for the prejudice against Reagan and his economic policy, a policy, that - according to the opponents - made the poor poorer and the rich richer and created a huge budget deficit and a gigantic public debt. Moreover (still in the opinion of the opponents) unemployment could only be reduced by low paid McJobs, or “hamburger jobs” as they are called in Belgium.

Reaganomics is probably the only economic doctrine that made its way into a pop song. In 1985, the British group Simply Red criticized the 'antisocial' policy of Reagan in their song “Money’s Too Tight To Mention” (actually, a cover version of an original American song by the Valentine Brothers from 1982).

I been laid off from work my rent is due

My kids all need brand new shoes

So I went to the bank to see what they could do

They said: son look like bad luck got a hold on you

Money's too tight to mention

I can't get an unemployment extension

Money's too tight to mention

[...]

We're talking about Reaganomics

Oh lord down in the Congress

They're passing all kinds of bills

From down Capitol Hill - we've tried them

Money's too tight to mention

Oh money money money money

Money's too tight to mention

Cutbacks!

[...]

The popular perception of Reaganomics is clear: an antisocial policy with a curtailment of social expenses. But criticizing Reaganomics is not the monopoly of the left. Even classical (i.e. pro free market) liberals and libertarians are convinced that although Reagan stimulated the economy, it came at the cost of an enormous budget deficit.

Even George Herbert Walker Bush was initially very sceptical of the economic ideas of Reagan. In 1980 he spoke about “voodoo economics”. He changed course when Reagan chose him as running mate for the presidency.

WILLY DE WIT: REAGANOMICS SAVED THE ECONOMY

Willy De Wit

THE FUNDAMENTAL FLAW IN KEYNESIAN LOGIC

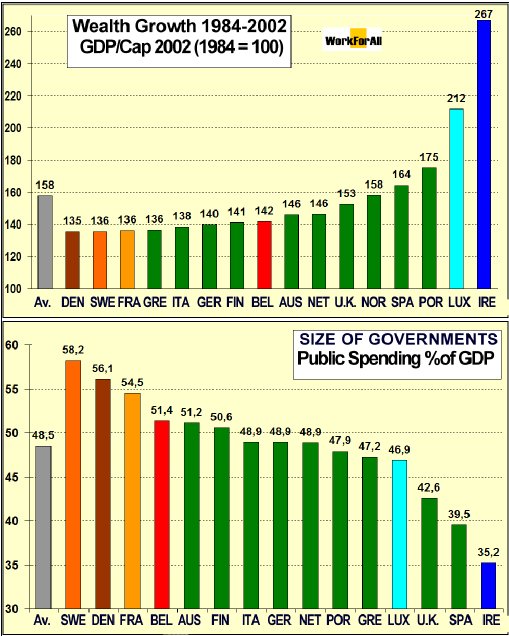

A lot of recent studies indicate that an increase in public spending (as advocated by Keynes) does not stimulate the economy. The main reason is that money that could otherwise be spent efficiently by the private sector, is instead siphoned off for pork-barreling public works, very often with little or no return. Money to pay for deficit spending must come from somewhere else and, as usual, it is the taxpayer who must pay. The fundamental flaw in Keynesian logic is that it hardly makes sense to tax money away from productive people, thereby reducing their rewards, so as to spend it on unproductive goals. Some call it robbing Peter to pay Paul. The United Kingdom, home of Keynesianism, experimented with this medicine for years - only to get sicker and sicker, until Margaret Thatcher stopped it. A more recent example is Japan. This country has provided one of history’s best demonstrations that the Keynesian demand stimulus is a deeply flawed economic philosophy. Despite huge government outlays, the Japanese economy is still wallowing in the slump that has afflicted it for more than ten years. This point of view is confirmed by a recent study (based on multiple regression analysis) from the Flemish independent think tank WorkForAll. According to their analysis of the relationship between economic growth and the size of governments in 16 European countries, the two main causes leading to poor growth performance are excessive government spending and a demotivating tax structure, which put a heavy burden on work, income and profit.

Moreover, many influential economists have come to the conclusion that the multiplier effect does not exist. See Paul A. Samuelson (“Economics", edition 1973, page 229), Harvard's Robert J. Barro (“Macroeconomics”, third edition page 301) and “The Wall Street Journal", November 3, 1992: ( “Keynes is still dead”)

STAGFLATION BECAME RECESSION, EXPANSION FOLLOWED

Four young economists (Paul Craig Roberts, Robert Mundell, Norman Ture and Steve Entin) and a journalist (Jude Wanniski) convinced Reagan to completely reverse the economic policy of that time. Their point of view was that high marginal tax rates were a disincentive to produce, to take risk, to invest and to save. In their opinion this “economy of discouragement” had to be transformed into an “economy of encouragement”. The reasoning was as follows: people are producing because it pays to do so. Consumption alone will not result in increased production when the incentives to do so are not there. When tax rates are raised, people reduce their participation in taxed activities, such as working, risk taking, saving and investing. When tax rates fall, people increase their participation. Fortunately, Reagan understood this logic immediately. Few people know that Reagan had a major in economics, which he obtained at the Eureka College (Illinois) in 1932. The economic theory he was taught was untouched by Keynesian thinking and, as a consequence, very appropriate to the problems of the eighties. Reagan followed the advice and took action. The top marginal tax rate of 70% was lowered in two phases: to 50% with the “ERTA” (Economic Recovery Tax Act of October 1, 1981) and in a later phase to 28% (The Tax Act of 1986). These tax cuts created 18 million new jobs in 8 years, lowered inflation to 4.3% and cut unemployment from 9.7% to 5.4%. One of the longest and strongest economic expansions since World War II had begun, with an average annual growth rate of 3.5%. But the first two years (1981 and 1982) were lost for Reagan. Fed chairman Paul Volcker fought inflation with a tight monetary policy and high interest rates. The Reagan administration urged Volcker to decrease monetary growth by a maximum of 50%, in order not to kill the tax cut program. But as the Federal Reserve is totally independent, Volcker cut money growth by 75% in 1981. The recession became even worse, and unemployment rose further. But after inflation had been defeated, money growth resumed and the Reagan expansion took shape.

DID THE POOR GET POORER AND THE RICH RICHER?

“Reagan gave money away to the rich, at the expense of the poor”, many critics claim. The table below proves the contrary. At the end of the Reagan presidency, the rich paid comparatively more taxes than before. As for the poor, their share in total tax revenues decreased. There was a simple reason for this: the lower tax rates were an important incentive for the rich to expand their economic activity.The tax base had become broader, and the lower rate on the broader tax base resulted in higher tax revenues.

| Percentage of paid income tax | |||

| Income | Percentage of taxes paid | ||

| 1984 | 1986 | 1987 | |

| $0 - $15,000 | 5.8% | 4.0% | 2.8% |

| $15,000 - $30,000 | 21.1% | 16.8% | 14.7% |

| $30,000 - $50,000 | 29.0% | 25.9% | 23.0% |

| $50,000 - $100,000 | 22.0% | 24.3% | 27.7% |

| $100,000 - $200,000 | 8.6% | 10.2% | 11.9% |

| + $200,000 | 13.4% | 18.9% | 19.8% |

| 100.0% | 100.0% | 100.0% | |

| Source: IRS | |||

In the table below we can see that the poor benefited most from the economic growth. Not only did they pay less taxes, but the 20% poorest people enjoyed an increase in income of 77 % in 9 years.

| Incomes and Social Mobility | |||

| (1991 dollars) | |||

| Average Family Income of 1977 Quintile Members in | |||

| 1977 Quintile | 1977 | 1986 | % Change |

| Bottom 20% | $15,853 | $27,998 | 77% |

| Second 20% | $31,349 | $43,041 | 37% |

| Third 20% | $43,297 | $51,796 | 20% |

| Fourth 20% | $57,486 | $63,314 | 10% |

| Top 20% | $92,531 | $97,140 | 5% |

| All | $48,101 | $56,658 | 18% |

| Source: Urban Institute | |||

HAMBURGER JOBS?

Critics claim that the growth in employment was realized mainly through the creation of crappy “hamburger jobs”. De Wit: "This is not correct. Universities could not follow to deliver enough high qualified graduates. As you can see in the following table, job growth was mainly in managerial functions. Low paid jobs in services increased very little and in farming, employment decreased".

| Job Creation in the Eighties | |||

| Jobs Created, Jan. 1982 – Dec. 1989 | |||

| Job Category | Number (Mils.) | Percentage Increase | 1989 Median Earnings |

| Managerial/Professional | 7.600 | 33.10% | $32,873 |

| Production | 2.194 | 19.00% | $25,831 |

| Technical | 6.630 | 21.80% | $20,905 |

| Operators | 1.374 | 8.20% | $19,886 |

| Services | 2.210 | 16.80% | $14,858 |

| Farming | -0.116 | -3.70% | $13,539 |

| Total | 19.892 | 20.30% | $23,333 |

| Source: Bureau of Labour Statistics (employment), Census Bureau (earnings) | |||

ENORMOUS PUBLIC DEBT?

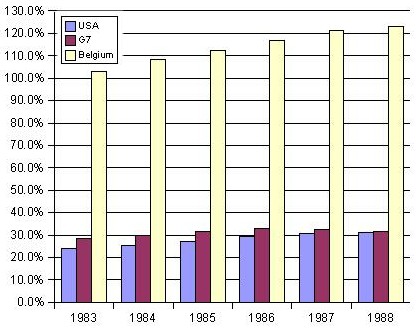

It is often claimed that the budget deficit had risen to enormous proportions during the Reagan years. But between 1981 and 1989 the budget deficit increased only slightly, from 2.6% to 2.9% of GDP. The deficit peaked in 1983 to 6.1% of GDP (the Volcker recession with tight money). During the same years the Belgian budget deficit varied between 7% and 13% of GDP. The average budget deficit for the G-7 countries was only slightly lower than that of the US.

The public debt of the US as a percentage of GDP, remained below that of the G-7 countries, i.e. below 32% of GDP. But Belgian public debt, the result of years of Keynesian policy, was higher than 100% of GDP and remains around 100% at this moment.

| Net Public Debt as a percentage of GDP | ||||||

| 1983 | 1984 | 1985 | 1986 | 1987 | 1988 | |

| USA | 24.1% | 25.2% | 27.3% | 29.6% | 30.9% | 31.2% |

| G7 | 28.4% | 29.8% | 31.4% | 32.9% | 32.7% | 31.8% |

| Belgium | 103.2% | 108.2% | 112.3% | 116.7% | 121.4% | 123.1% |

WHY THE CRITICISM?

It seems strange that these figures and these facts are not better known, says Willy De Wit. But probably it is not surprising, when we consider that a right wing ("conservative") president discredited the left wing ("liberal") economic policy. Increasing social outlays doesn’t make sense when you have previously created unemployment and poverty with a wrong economic policy. Reagan has shown that the redistribution of wealth with high tax rates brings no solution. Instead of redistributing wealth, it distributes poverty. The main reason for the opposition to Reagan’s economic policy, however, was that this policy was completely misunderstood at that time, mainly by the economic establishment. They did not see the fundamental difference between Keynesian thinking to stimulate demand, and the new supply-side approach by Ronald Reagan.

Keynesian thinking explained the economic achievement in terms of the level of spending. Deficit spending will keep employment high and will stimulate the economy. Cutting the deficit (for the Keynesians) would reduce spending and throw people out of work, raising the unemployment rate, reduce national income and hence produce less tax revenues. Reagan on the contrary brought a totally new perspective to economic policy. Instead of putting the emphasis on spending, supply-side economists showed that tax rates directly affect the supply of goods and services. Lowering tax rates mean better incentives to produce, to save, to invest and to take risks. In other words lower tax rates stimulate supply and not demand. The broader tax base will compensate at least partially for the lost revenue caused by the tax cut. Higher savings will result in increased investment and unemployment will disappear. Instead of pumping up demand to stimulate the economy, reliance would be placed on improving incentives on the supply side.

The entire economic profession, along with the media could not believe that a former movie actor could come up with a revolutionary economic policy that completely contradicted the famous Keynesian theory. The reaction was fierce.

Another reason is that public opinion and most of the politicians in Europe are against the US. Roland Leuschel, a Belgian investment stategist with German roots and a good friend of Jack Kemp with whom he wrote a book in German, "Die Amerikanische Idee" (which was also published in Dutch but is out of print), dedicated a complete chapter of this book to this phenomenon: “the favorite sport of the European intelligentsia: anti-Americanism”.

REAGAN, NOT THE FIRST AND NOT THE ONLY ONE

Time, Nov. 1, 1963

Later on Erhard, as secretary for the economy, cut the high marginal tax rate in two steps: first from 95% to 63% and afterwards to 53%. The first 8000 DM earned became tax free.

The decisions taken by Ludwig Erhard allowed West-Germany to rebuild itself at a pace never seen. No surprise that he was called the “father of the wirtschaftswunder”.

The German economic miracle cannot be explained by the Marshall Plan. Britain and France received Marshall money too, but they wasted their chances. Britain voted Labour, which brought rationing and price controls. France opted for economic protectionism, which prevented Marshal help to be used in an efficient way.

After Reagan, the theory of supply-side economics was applied in numerous countries. In Iceland, David Oddson became prime minister in 1991. He inherited a poorly performing economy burdened by heavy income taxes. He lowered the corporate tax rate from 50% to 30%. During the next five years the economy grew by 5% per year. Government income did not fall and social outlays could be maintained.

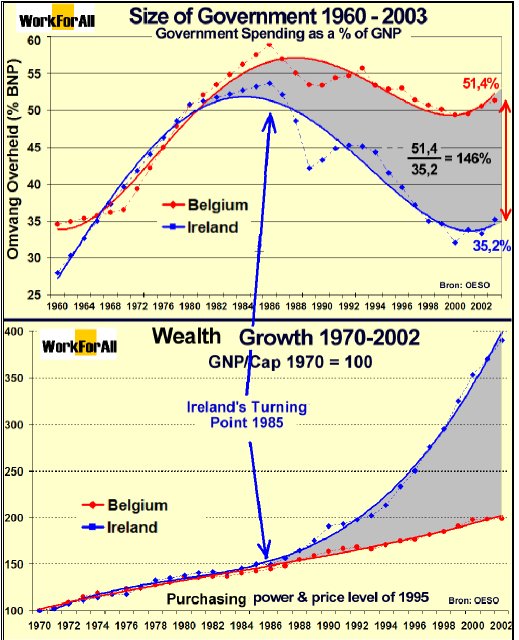

Ireland is another example. In 1987 this country was the “sick man” of Europe, with a public debt of 135 % of GDP. After the elections of 1987 a new economic policy was introduced. Corporate tax rate was reduced from 32% to 12.5% and capital gains tax was lowered from 40% to 20%. Ireland is now the fastest growing country of the EU. Japan, to the contrary, is a classic example of the failure of a Keynesian demand-side policy. The economy has been in shambles for many years and public debt has risen to a gigantic 170% of GDP.

The following graph compares government spending and GDP per capita in Ireland and Belgium between 1960 and 2003. The Irish 'turning point' came with the adoption of supply-side economics.

REAGANOMICS, STILL RELEVANT TODAY

During the Reagan Presidency (1980-1988) an economic revolution unfolded. An unprecedented welfare expansion took place with the creation of 18 million new jobs. The understanding of the mechanism behind this economic miracle is important, because it can offer some tools to revive the economies in countries with overregulation and big governments.

Willy De Wit: "Belgian politicians apparently have no knowledge about supply-side economics. Universities are still teaching the theory of Keynes and the economic establishment does not seem to understand Reaganomics nor supply-side economics. Hence it is not surprising that Belgium has one of the heaviest levels of taxation in the world, a high unemployment rate and an increasing number of companies that are leaving the country. The media are still praising Keynes. Paul D’Hoore, the economics advisor of the Flemish public television service VRT is an admiror of Keynes. His book “De 100 kapitale vragen van Paul D’Hoore over mensen en geld” (100 major questions on people and money) is mainly about micro-economics. The few lines on macroeconomics are completely in line with Keynesian thinking. Meanwhile the economic time-bomb is ticking for Belgium: high unemployment figures, an ageing population and the pension problem, the brain drain and an unbearable tax burden".

A REAGANOMICS PLAN FOR BELGIUM

Willy De Wit has a six point blueprint for the Belgian economy, based on Reaganomics. "My program can create 600.000 jobs", he claims.

- A gradual but considerable cut of the highest marginal tax rates to 28%.

- The complete abolition of corporate taxes, with a repeal of all subsidies to corporations.

- The abolition of taxes on dividends. Investment and risk taking has to be encouraged, not punished. A reduction (or abolition) of tax rates can make investment opportunities profitable that formerly were not.

- The abolition of all agricultural subsidies. At this moment 45% of the total EU budget goes to agricultural subsidies, respresenting the huge amount of 45 billion euro per year. This is not only dramatic for the tax payers, but it is also very harmful for the developing world, mainly for the poor countries in Africa. As a consequence of the subsidies, European agricultural products are dumped (at prices far below the cost) on the markets of these countries, preventing them from competing on the world markets with their own products. To pacify our conscience for this scandalous behaviour, policy makers have created a government department for foreign aid. Allegedly, this is a compensation for the money we stole from the poor countries through agricultural subsidies for our own products. The tax payer has to pay twice: first for the subsidies and then for the foreign aid. It is a shame that Europe is pumping such huge amounts into agriculture, a sector we hardly need.

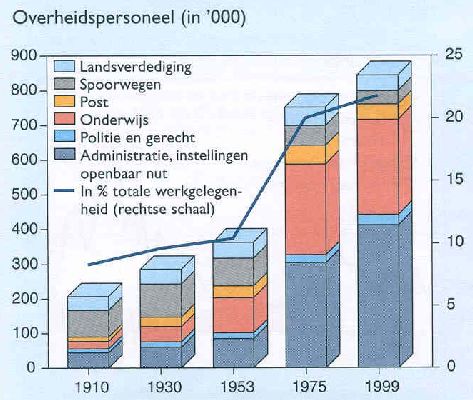

- A shrinking of the size of government. One out of four Belgians are working for the government. According to an analysis of the independent Flemish think tank Workforall the total cost of government in Belgium could be reduced by 50%.

- Abolition of the transfers of tax money from Flanders to Wallonia. About 10 billion euro is transferred each year from the Flemish tax payers to the French speaking part of Belgium. The reason invoked for these transfers is that Wallonia has an unemployment rate of 18% compared with 8% for Flanders. But the socialist political parties and the unions in Wallonia refuse to take structural measures to reinvogorate their economy. So long as Flanders continues to pay the unemployment benefits for Wallonia the latter have no stimulus to do so. A solution could be the splitup of Belgium into two parts. In a recent study, "The Size of Nations", professors Alesina and Spolaore demonstrate that it is easier for small countries to become rich than for large countries. Of the ten richest countries in the world (in terms of GDP), only four have more than 1 million inhabitants, and only one (the US) has more than 10 million. Flanders, Wallonia and Brussels could prosper more as separate states or as a confederation, compared to the present situation in a united Belgium.

Evolution of government employment in Belgium - source: KBC & WorkForAll. From top to bottom: defense, railways, postal service, education, police and justice, administration.

DEFENSE SPENDING

I asked Willy De Wit the following question. Public spending increased during the Reagan era, mainly due to the growth of defense expenditures. The Soviet Union could not keep up with the arms race and its economy was slowing down. Within three years after the end of the Reagan Presidency, we saw the iron curtain fall and the Soviet Union collapse. Was this military buildup a Keynesian measure, a disguised subsidy to the defense industry? Surely this defense spending was not a supply-side stimulus, because it created an artificial demand for military equipment?

Willy De Wit: You are completely right. Defense spending is a typical Keynesian demand-side policy and is certainly not a supply-side approach. Supply-side economics has nothing to do with expenses, but with the creation of incentives to produce, to take risk, to work, to invest and to save. Reagan saw the increase of defense expenditures as a necessary evil, to safeguard the security of the US in the long term. Without this defense buildup (which was the main cause of the increase in public spending) government outlays would have been considerably lower, and the success of Reaganomics would have been even more pronounced. Indeed, supply-side economics has taught us that an increase in government spending does not boost economic growth. On the contrary, recent studies have clearly shown that there is an inverse relation between economic growth and the level of public spending. This means that the increase of the defense expenditures during the Reagan era has lowered economic growth. Money invested in defense was lost for more productive investments in the private sector. Anyway, we must keep in mind that the Reagan budget deficit was not caused by the tax cuts, but by the increase in spending (mainly for defense), and paradoxically by an increase in social outlays, i.e. 2.9% per year during the first four years of the Reagan Presidency. That is an indication that Reagan was not an anti-social president.

SUPPLY-SIDE ECONOMICS AND THE LAFFER CURVE

Laffer curve

WHAT ABOUT A FLAT TAX?

An even better solution than the above six point program, would be the introduction of a flat tax rate, not only in Belgium, but also in the (original) 15 EU countries. The flat tax is a system with only one tax rate for all income and profits. If for instance a flat tax of 20% were introduced it would apply to all personal income and corporate profits. All reliefs, deductions, allowances and subsidies will be eliminated. Loopholes would be impossible. The system would be so simple that it will perhaps take no more than five minutes to file a tax return. In the last decade, the flat tax system has been introduced in several countries of "the new Europe", namely Romania, Slovakia, Servia, Lithuania, Latvia, Estonia and also in Russia, Ukraine and Georgia with rates varying from 12% to 33% (average rate of 19%). Estonia was the first to introduce this system in 1994 (at a rate of 26 %) and has seen its economy expand at a fast rate.

A low level of a flat tax is important. The well-known Richard K. Armey, previous Majority Leader of the House of Representatives advocates a tariff for the US of maximum 17%. But this rate could even be lower. An analysis by the French economist Philippe Manière indicates that a flat tax rate of 10% in France would maintain the government revenues at the present level.

For Belgium, the introduction of a flat tax rate of maximum 20% would have enormous advantages a.o. :

- The economic growth rate will explode. Indeed a strong incentive is created to produce, to take risk, to work, to invest and to save.

- Unemployment will disappear completely.

- Tax Evasion will belong to the past. People are willing to pay the correct tax burden when tax rates are low.

- An important part of a suffocating government bureaucracy can be eliminated and the employees can be switched to more productive tasks.

Will Reaganomics or supply-side economics ever be applied in Belgium? In the UK, Ireland, Iceland and Eastern Europe current economic policy has strong supply-side influences. Currently Germany is in a worse socio-economic situation than Belgium. Who knows, some day Germany might return to the successful formula of Ludwig Erhard and create a new Wirtschaftswunder, by applying supply-side economics. Such an example could show the way for Belgium and other countries.

MORE READING ON REAGANOMICS

"Reagonomics or 'voodoo economics'?", BBC News, 5 June 2004

Reaganomics on Wikipedia, the free encyclopedia

"Reagan changed the world", Paul Craig Roberts, Townhall.com, 7 June 2004

"Reagonomics -- Then, Now, and Forever", Larry Kudlow and Stephen Moore, The Club for Growth, 12 June 2004

Reaganomics, William A. Niskanen, The Concise Encyclopedia of Economics

The Myths of Reaganomics, Murray N. Rothbard, Ludwig von Mises Institute

Supply Tax Cuts and the Truth About the Reagan Economic Record, William A. Niskanen and Stephen Moore, The Cato Institute

The Seven Fat Years and How to Do It Again, Robert Bartley

support for supply side economies, or Reaganomics

Submitted by Tom Potoms on Sat, 2006-06-24 15:24.

We should imply a supply side economy here in Flanders!

Tom Potoms, voor een conservatief, christelijk-joods en Vlaams- nationaal Vlaanderen

What is it with this fetish

Submitted by Anonymous (not verified) on Fri, 2005-08-05 22:02.

What is it with this fetish with a "flat tax"? All the benefits you named are benefits of a lower tax, not its flatness.

To promote a flat tax you have to actually explain why raising the marginal rate for lower tax brackets and lowering it for higher brackets matters. You have to make an argument about higher income citizens spending their money more productively or something, something that would of course be pretty politically distasteful to most.

So instead we see these dishonest arguments that the flat tax is better because of all these benefits that are really all about it being lower.

You do toss the throwaway line about eliminating bureaucracy. Except that as well would have nothing to do with the flatness of the tax. Progressive tax rates requires looking up your income against a single table at the end of your tax return. Eliminating that table won't eliminate one bureaucrat anywhere. Eliminating deductions would but again that has nothing to do with flatness.

Progressive tax rates

Submitted by Bob Doney on Sat, 2005-08-06 12:47.

Progressive tax rates requires looking up your income against a single table at the end of your tax return.

In a truly "flat" regime tax returns wouldn't be necessary for most taxpayers. "X" per cent of wages cost would be paid over by their employers. So unless the taxpayer had more than one job there would be no need for a tax return.

That would save a few bureaucrats, eh!

Bob Doney

Reaganomics

Submitted by Anonymous (not verified) on Thu, 2005-07-21 11:17.

To : Blunt (VH)

As for the huge budget deficit (as you call it) : did you look at the figures?

You also write : ...he (Reagan) eroded the

dollar. Same question.

Willy

Blunt

Submitted by VHfc on Thu, 2005-07-21 03:46.

And yet, it is a blunt fact that Reagan created a hughe US budget deficit that still haunts them now. Maybe Reagan was just another Big Spender, not on Social Security (God forbid), but on lunatic projects like the Star Wars missile shield. He returned the US its pride after Watergate, true, but he eroded the dollar and the balance of payments. His expensive bluff made the USSR implode a few years earlier, but only because Gorbachev let him to. He was a hell of a bad actor, and he added a very Filipino touch to American politics.

Blunt, as in not sharp?

Submitted by Elaib (not verified) on Fri, 2005-07-22 08:34.

"His expensive bluff made the USSR implode a few years earlier, but only because Gorbachev let him to".

What part of this doesn't add up.

Expensive - fine

Bluff - BUt it did work, therefore it was worth it

a few years earlier - did anybody see the signs, did anybody spot the cracks? No because without his leadership (ably supported by the noble Baroness, and the late Holy Father I might add) the west would have continued down its appeasing route. Thus we cannot tell how many years, but talk to anybody from the eastern bloc about those days, and they will most likely tell you that they date their hope from Reagan's description of the Soviet behemoth as "The evil empire", finally somebody had the measure of it.

And your piece de resistance, "Gorbachev let him to".

What tosh, shiny, globular tosh. No he didn't, he was forced, dragged screaming, had no choice, any other synonym you care to mention that makes it clear that Glasnost and Perestoika were the direct result of pressure, not voluntary actions.

Voodoo

Submitted by Bob Doney on Wed, 2005-07-20 11:15.

A very interesting article.

Unfortunately in the UK our little "economic miracle" is about to be destroyed by the failure to understand Ronnie's ideas. Gordon Brown, our Chancellor (Finance Minister)- who will become Prime Minister in about 2 years - is already increasing taxes and Social Security charges, and this will accelerate as his spending on health and other public works increases. Couple this with a downturn in growth and we will be caught in a trap of increasing expenditure and falling tax revenues, leading to higher taxes and so on and so on. Most of the new jobs now being created in the UK are public sector, with much better pension schemes than the private sector, all of which will have to paid out of future taxes.

The Conservative Party are too feeble and frightened to offer a Reaganomics-based alternative, and the third party, the Liberal Democrats, broadly share Brown's tax-and-spend policies.

No doubt all this will be very cheering to our European neighbours. Within a very few years our economy will be stuck in the same deep rut as yours.

Bob Doney