The Gluttons Got Inside the Cookie Jar

From the desk of George Handlery on Sat, 2011-01-15 13:54

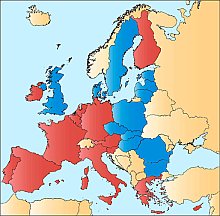

Why to avoid the stampede into the European Union. Exchange rates. Membership, pretentions and the benefits.

1. The appetite of the European Union to expand is abating. Even Brussels seems to realize that quantity does not substitute for quality. Refusing Romania’s and Bulgaria’s adhesion to the Schengen Treaty -it eliminates border passport control- is symptomatic. The abolition of “borders” among members places a burden on countries bordering non-members. These are being deputized to protect their outside borders in behalf of the EU.

What the Union continues to want is to swallow in Switzerland. That little white spot in the middle of “Euroland” is seen as a disturbing blemish. The Helvetic Republic continues to be coveted. If a member, it would be, in terms of development, institutional integrity, governance, wealth and the imposed payments to Europe, at the top of the list. The newest competitiveness rating by the Heritage Foundation confirms this. Composed out of four nations, it is the most European state of the Continent. At the same time, however, internally resistance grows against the merger into the Union as it is being run at this time. The reluctant country has a tradition of standing apart –see the centuries old tradition of armed neutrality. Switzerland is doing all it can to stave off “Europe’s” pressure to become a full member. Meanwhile, she shovels billions over to the EU to contribute to the upgrading of the laggard members’ ailing economies. She also cooperates in every way by taking over numerous EU laws and regulations. The hope is that by cooperating the pressure to join might be halted. The signs, however, point to more coercion. One of these is Brussels’ threat to cease to negotiate further bilateral agreements with Berne. That blockade threatens to undermine the landlocked country’s ability to preserve its independence.

More than economic considerations play a role in the refusal to join voluntarily before a full-scale checkmate. Naturally, the role of spewing assets into a money-shredding machine is hardly a factor of attraction. The Euro’s crisis, too, has the opposite effect of a magnetic force. In themselves, the €’s nose-dive and its economic policies might all be good reasons to try to avoid annexation. Comprehensible, if one remembers the budget with a per capita surplus of $400.00 in 2010. (project this on the country where you read this!) Of equal weight is a political problem.

When Hitler’s hordes marched along the common borders, they liked to sing a marching song. One of its lines was something like “Switzerland you impertinent porcupine, we will get you on our way home.” Swiss federalism and direct democracy are, indeed, an irritant to the emerging European system. Assuredly, these constitute a tradition that departs from the Continent’s. It also contradicts the national systems of the EU’s members. Furthermore, it does not mesh with EU-centralism and the bureaucratism that is used as a substitute of the missing bond among members. No matter what the local and foreign campaigners for adhesion promise, government by popular sovereignty and the EU practices are incompatible. Thus, it would seem that Switzerland is wanted for positive reasons, such as its gold reserves, its advanced industries and her control of North-South communications over the Alps. There is a negative cause for coveting the seven million country. It is that its institutions and practices are an attractive example of alternatives. As such, it could potentially lure those that might be disappointed by the union. Switzerland is an example of a successful federal system. That is one which might contradict the EU’s approach but which, nevertheless, works well and does so by ignoring the prevailing EU pattern.

2. Economic innocents tend to make an assumption. It applies a superficial logic that is convincing as long as its false premises and ignored facts are allowed to stand. The error is similar to concluding that the earth must be flat. Just by looking at it from where one stands, flatness, which is visible to all, appears to be irrefutable. The phenomenon to be addressed here concerns exchange rates.

The average citizen is inclined to assume that the exchange rate of his national currency is a measure of his country’s international prestige and of economic soundness. Satisfaction from a favorable exchange grows when one travels. Low rates lead to frustration when purchasing foreign goods. In real life, the exchange rate and economic health are only loosely connected.

At the same time, when a currency’s value changes abruptly relative to gold or other hard currencies, the move probably contains a message. This your correspondent experiences on a personal level. Living economically in the Dollar, the Swiss Franc and the Euro zones, the drift of exchange rates becomes more than a mathematical challenge. In 1972 a dollar bought 4.35 Francs. Today you get 0.95. The € went from 1.6+ CHF to under 1.30. Tendency falling. Viewing from the street level, these exchange rates have no relationship to the purchasing power expressed in “Macs” or “gizmos”. It is all about confidence, trust and informed guesses about coming events.

In some of the economies named, the bozos have gotten loose. The lid of the public-funds cookie-jar is under the control of gluttons. There might be defiant talk of having reached the bottom – that tends to happen just before it again falls out. All attempts to stop the hemorrhage, such as the Swiss National Bank purchasing billions of bad Euros with real money, are failing. Explanations that the cheap $ and the sale on the € facilitates exports, do not help. Practice dismisses the claims. All reminders are ignored that Switzerland lives off its exported industrial products – and not the banks, as many like to believe. Exports are predestined to shrink because what is offered becomes too expensive for the customer. This should make the CHF lose in value. Normally, such considerations would be more effective than a firecracker fired at a Dreadnaught. The sinking and the rise of the currencies mentioned can be reduced to a simple explanation.

The value of a safe haven – such as the Swiss Franc or Gold - expresses a crisis of confidence. Therefore, such a currency’s value is divorced from dividends, the quality of the economy’s output and relative prices. Once all the rhetorical grandstanding is, like the skin of a banana, peeled away, the money is not put where the soothing preacher’s mouth is. America and "Euroland" are badly run. Additionally, the latter is a “plastic” creation. It is the consequence of this that really determines the exchange rate.

3. This is the juncture to refer to an illuminating tale regarding one of the fundamental problems of the European Union. For the official EU, integration seems to have attained a novel meaning. Under the policy of accelerated inclusion, unfit members are admitted. The expectation is that they will rise to the level at which, according to the organization’s ignored rules, initial admission would be contemplated.

4. Serbia is trying to get closer to the EU. Doing so brings financial benefits that is handed over as aid to accelerate development. The problem is the case of the indicted mass murderer, General Ratko Mladich. While the court in The Hague is still looking for him, he remains on the loose in Serbia. The power elite of that country is protecting him. Most Serbs still regard him as a hero. After all, he killed in their name and for their alleged benefit. The loss incurred is 159 € per month for every inhabitant of that state. That is about half of the average of the per capita income there.

These numbers have a revealing quality. They betray the extent of the profit of following the recruitment call that makes one a member of an association of allegedly advanced democratic states. This sounds like someone that is purchasing a pair of boots and then amputating his toes to make the foot fit.

another Handlery understatement...

Submitted by mpresley on Sat, 2011-01-15 15:05.

...when a currency’s value changes abruptly relative to gold or other hard currencies, the move probably contains a message.

I guess. But, today, the message may be that there are no "hard currencies" left in the world. Gold has pretty much become strictly a commodity, albeit one that can be used to track existing monetary devaluation; it cannot be rightly termed currency, anymore, although that could well change as government backed denominations (led by the ever-popular Bernanke Buck) devalue themselves into oblivion. At least it has been so ever since de Gaulle and Nixon conspired to dissolve Bretton-Woods (for the literal it is just my lame attempt at humor; I hate to be a crank so early in the AM).